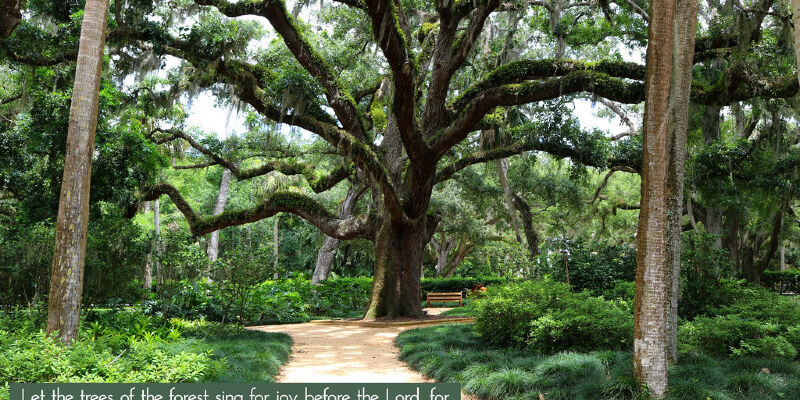

How to Boost a Weeping Fig Ficus in a Container

Also known as Java laurel or weeping Chinese banyan, Weeping fig ficus (Ficus benjamina) is a compact, upright evergreen tree valued for its shiny green leaves. Although weeping fig ficus is acceptable for growing outdoors in U.S. Department of Agriculture hardiness zones 9 to 11, it can be nipped by frost in exposed areas. It Read more about How to Boost a Weeping Fig Ficus in a Container[…]